Are you covered?

Insurance topics to discuss with your agent.

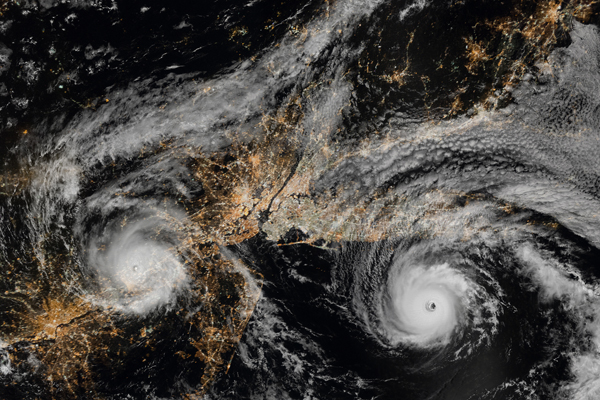

Windstorm reminder

June 1 – Nov. 30 is hurricane season. And although the Northeast may not be quite the hurricane mecca that the Gulf coast is, hurricanes and windstorms are still a real threat to homeowners along the eastern seaboard.

A home near the coast typically has a higher deductible for windstorm loss than for other causes of loss such as fire or theft. And, inland households are not immune to the risk either. A hurricane can have a good, long reach and don’t forget, even a thunderstorm can cause significant wind damage. The deductible applies to each windstorm or hurricane that causes damage.

Although damage from windstorms is covered by all standard homeowners policies, our agency doesn’t want a windstorm to be the moment you decide to check your homeowners policy. We would rather you knew in advance. So, please, if you aren’t sure what your deductible is, give us a call.

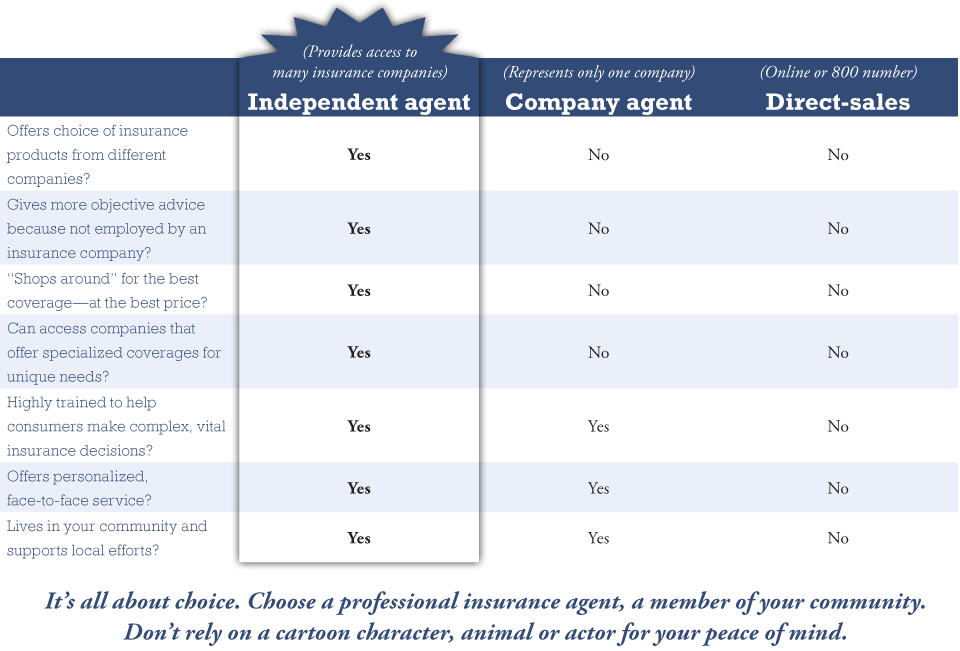

Why a professional, independent insurance agent?

An independent agent will evaluate your unique situation, find the best price/coverage ratio from a variety of insurance companies and develop a cost effective policy package to meet your specific needs.

At a time of crisis, would you rather meet with someone you know and trust, or be told that the next available operator will be with you momentarily?